The following information is the content from the Planning for Retirement (Powerpoint Presentation) for those who are unable to open the PowerPoint file.

Slide 1: Planning For Retirement

Slide 2: Eligibility Requirements

Per Board Of Trustees policy, employees are eligible to retire if they:

- are at least age 55

and

- have at least 10 years of service immediately preceding retirement.

Slide 3: Social Security & Medicare

Social Security:

socialsecurity.gov (External Site)

- If age 62 or older at retirement, you can contact Social Security for payment of benefits.

Medicare:

To continue medical coverage as a retiree, you and your spouse/partner MUST BOTH enroll in Medicare Parts A & B if/when eligible:

- Part A – Hospitalization

- Part B – Primary Care

Do not enroll in Medicare D – Prescription Drug coverage since retirement medical plan options may have an Rx. Plan that could qualify as Medicare D.

Slide 4: Incentive Retirement Plan (IRP)

- Provides lump sum payment to TIAA

- Works in conjunction with partial/phased retirement program

- Retirement income may begin immediately or be deferred

Note: To confirm your eligibility for the IRP, please “model” your future retirement within the University of Maine System (UMS) Retirement Guide within MaineStreet Self-Service.

Slide 5: IRP Eligibility

- Full-Time Regular and Faculty Unit (Hired Prior To July 1, 1996)

or

- Non-Represented Faculty (Hired Prior To July 1, 1996)

or

- Represented Professional/Administrative Staff (Hired Prior To July 1, 2006)

or

- Non-Represented Professional/Administrative Staff (Hired Prior To July 1, 2006)

and

- Age 55+ with 10+ years service

and

- Enrolled in Retirement Plan for Faculty and Professional Employees.

Slide 6: IRP Application Procedure

- Discuss with spouse/partner

- Obtain income, benefits, legal, tax advice

- Complete MaineStreet Self-Service Retirement Guide

Slide 7: IRP Terms

- Available at full retirement

- Lump sum payment calculated at 1½% times completed years of service times the final annual base salary (27 Year Maximum)

- Lump sum payment is tax-sheltered up to IRS limits

- Partial Phased Retirement Plan (PPRP) salary converted to full salary at retirement

Slide 8: Retirement Health Insurance

- Employee Under Age 65

- Employee Age 65 Or Over

- Employee Retires Prior To Age 65

- Employee Retires At Age 65 Or Over

Slide 9: Retirement Prior To Age 65

- Optional Cigna Copay Or Choice Plan (No HSA) with Prescription Drug Program

- Aetna Medicare Advantage Plan for Medicare Eligible Spouse/Domestic Partner

- Retiree and Dependent Coverage Paid by Retiree (Premium may be debited from checking account or savings account)

Slide 10: Retiree Opt Out And Re-Enrollment

Non-Medicare-Eligible Retirees have a one-time option to cease coverage:

- May re-enroll when eligible for Medicare

- Verification of continuous coverage required upon re-enrollment

For detailed information on the opt out and re-enrollment provision, please contact the UMS Employee Benefits Center.

Slide 11: Retiree Opt Out And Re-Enrollment Provision

Change Effective April 1, 2008

Effective April 1, 2008 retirees have a one-time option to cease coverage under the UMS health plan with an opportunity to reenroll in the UMS health plan, provided that the election to re-enroll occurs no later than ninety (90) days after the retiree becomes eligible for medicare and the retiree documents continuous coverage for themselves and dependents during the period for which they were not covered in the UMS health plan.

UMS does not remind the retiree and it is the retiree’s responsibility to request re-enrollment within the allowable 90 days.

Also, if a retiree exercises their one-time opt out, reenrolls, and later cancels their

Health coverage, their coverage may not be reinstated in the future.

Slide 12: Retiree Health Plan (Age 65+)

UMS offers a choice for 2022 when it comes to health insurance plan enrollment for retirees 65 years of age or older.

Retirees (and their spouses or eligible dependents) can choose to enroll in one of the following options:

- A health plan on the Aon Retiree Health Exchange

- Enrollment in the University-sponsored Aetna group health plan

Slide 13: Retirement Age 65 Or Over

- Medicare A — (Hospitalization) No Cost to Retiree

- Medicare B — (Primary Care) Paid by Retiree @ $170.10 /Month)

Note: Employee must enroll to be eligible to continue university health coverage

Slide 14: Medicare Employer Form

For medicare eligible retirees, you must have medicare a&b in place as of your retirement date to enroll into the Aetna group health plan.

The pre-populated form for over 65 retirees is located within the retirement guide. Please print it off and submit to Social Security Administration (SSA) along with their required form. This needs to be started no sooner than three months prior to your retirement date but needs to be completed as soon as feasibly possible if your retirement is within the next 90 days.

Slide 15: AETNA Group Health Plan Design

- Copays apply when treated by doctors and specialists

- All diagnostic services get applied to a $300.00 Plan Deductible

- Once deductible is met, the plan will pay 90%, you pay 10% (co-insurance) until your deductible and co-insurance reaches the yearly out of pocket of $2750.00 per person

- Prescription Drugs – Under our Aetna plan, prescriptions are paid at a copay level regardless of the cost of the drug. There is no “donut hole” under our Aetna plan, meaning you will always pay a copay

- Aetna has a monthly cost of $54.00* for the retiree and $136.00* for the spouse. This is in addition to Medicare Part B.

*Subject to premium change in the future

Slide 16: Retiree Health Exchange

For Medicare eligible retirees, you Must Have Medicare A&B in place.

Plan Designs under Aon/Alight Retiree Health Exchange

- The exchange offers many plans including Advantage Plans and Medigap/Supplemental Plans.

- The costs of these plans can vary from no monthly premium to $200+/month.

- A benefits adviser with meet with you to determine what plan or plans work for you and your eligible dependents.

- Any plan through Aon/Alight is an individual plan (not group plan) and the “donut hole” for prescription drugs will apply.

Slide 17: Health Reimbursement Account (HRA)

- $2,100 Annual Retiree HRA Contribution

- $800 Annual Spouse/Survivor HRA Contribution

Slide 18: Catastrophic HRA

You will have an annual maximum out-of-pocket prescription cost limit of $1,500. Essentially this puts a “cap” on annual out-of-pocket prescription drug expenses at $1,500.

Once you hit or exceed the $1,500 out of pocket cost, you will contact AON and provide them with a copy of the explanation of benefits (EOB) and they will set up reimbursement of any out-of-pocket expenses over $1,500 up to an annual maximum of $1 million dollars.

You will then be able to send in receipts for any out-of-pocket prescription costs that you incur, or send in your monthly EOB’s to AON for reimbursement.

Slide 19: Group Dental Coverage

When you retire from the University of Maine System, you have the option of retaining dental coverage through the University’s retiree dental plan (Northeast Delta Dental).

At whatever age you retire, you need to complete the MaineStreet Self-Service Retirement Guide to elect dental coverage.

You may elect to authorize EBPA (3rd party billing) to debit your checking or savings account for the monthly dental premium.

2022 Monthly Dental Premium Rates:

- $51.41 (Single)

- $94.10 (2-Person)

- $160.68 (Family)

Slide 20: Vision Insurance

- Vision Insurance will terminate at the end of the month in which you retire.

- The Consolidated Omnibus Budget Reconciliation Act (COBRA) continuation is available if you are covered at retirement. You will be mailed a COBRA election notice.

- Individual Vision plans may be available through the Aon /Alight Retiree Exchange.

Slide 21: Other Benefit Eligibility

The Standard Group Term Life Insurance Terminates at Time or Retirement

You may convert your group term life insurance to an individual policy and/or port your coverage.

Farmers Group Homeowners & Automobile Insurance

Group discounts continue – payroll deductions stop

CIGNA Employee Assistance Program (EAP)

Eligibility continues

Flexible Spending Account – Healthcare

Coverage may continue via COBRA- Please note that you must incur charges prior to your retirement date in order to use current funds or you can continue via COBRA.

Nationwide Pet Insurance

Group discounts continue – payroll deductions stop

Slide 22: TIAA

Contact your retirement account vendor or TIAA at 1-800-842-2776 to discuss your benefits post-retirement.

Slide 23: Retirement Guide – How to

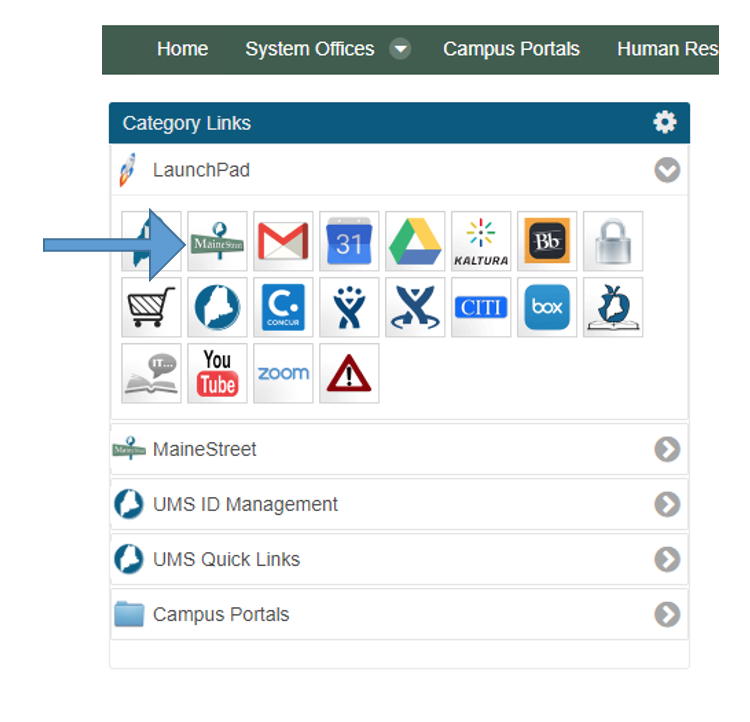

- From mycampus home

page to MaineStreet - Select the Employee Self Service option from the menu

Slide 24: Retirement Guide – How to continued

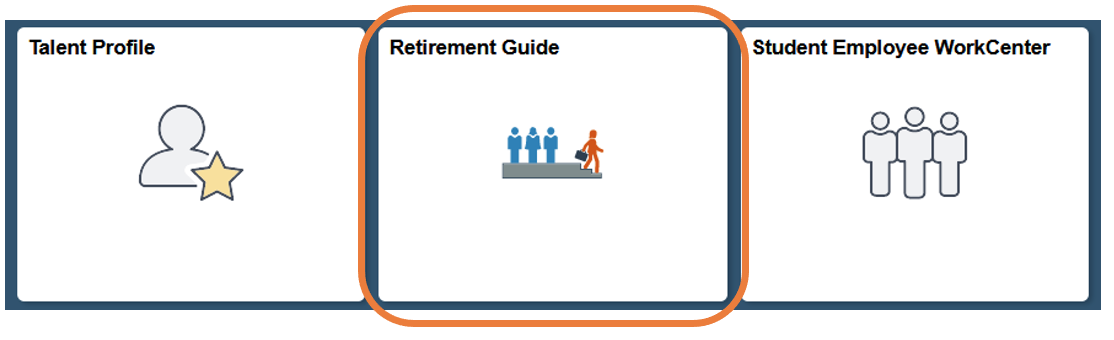

Select the tile labelled Retirement Guide

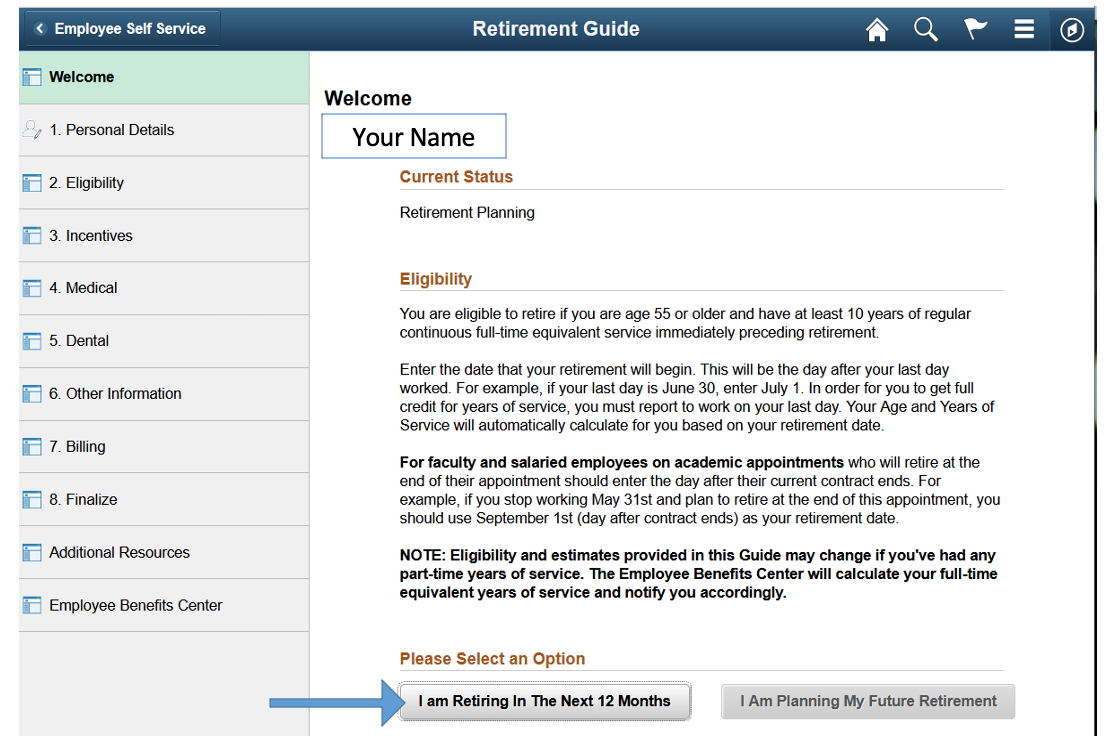

Slide 25: Choose an option

Select “I am Retiring in The Next 12 Months” or “I Am Planning My Future Retirement.”

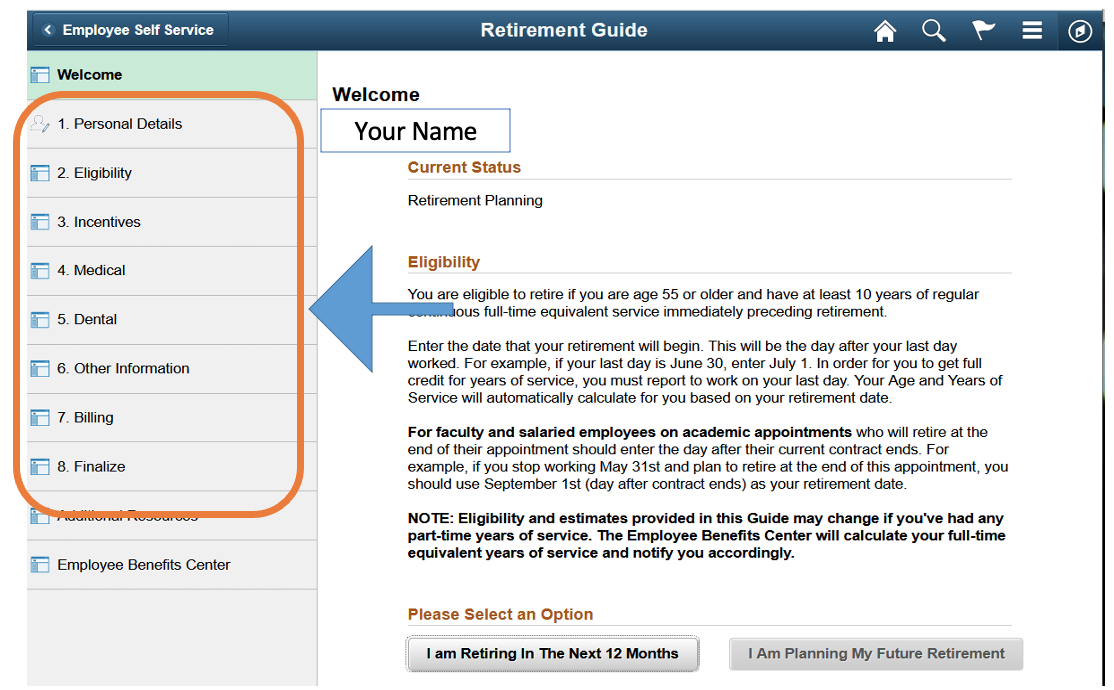

Slide 26: Review and update steps 1 – 8 on left

Steps on the left sidebar:

- Personal Data

- Eligibility,

- Incentives

- Medical

- Dental

- Other Information

- Billing

- Finalize

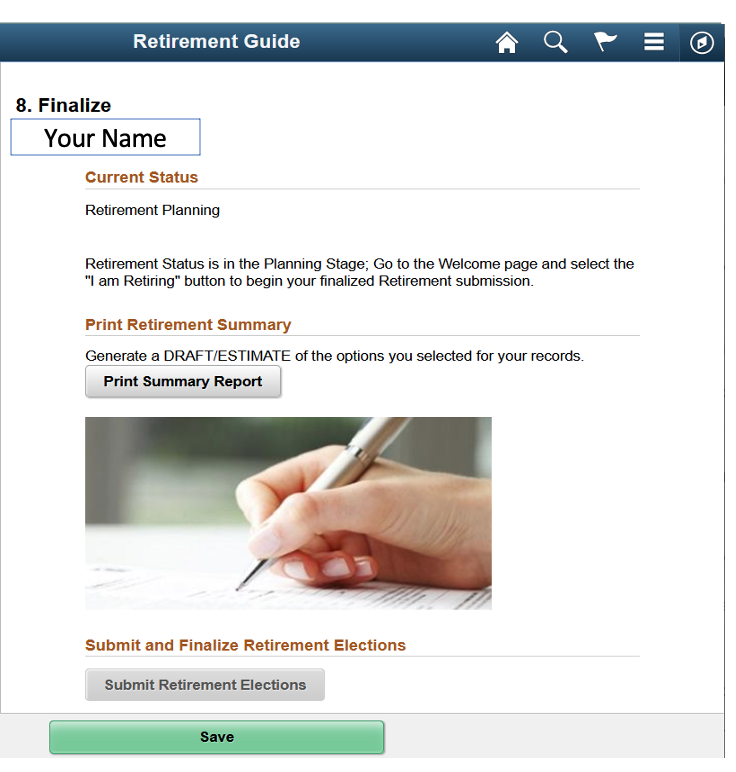

Slide 27: Finalize your Retirement Elections

- Save and confirm elections

- Print summary report

- Submit retirement elections

Slide 28: Finalize your Retirement Elections

Make sure when submitting your retirement elections that you:

- Click Submit Retirement Elections,

- Click Yes, then click Save.

Once you have followed these steps and have printed your Retirement Summary, the guide will notify you that you are finalized.

Please Note: You Are Only Submitting / Finalizing Your Retirement Date. Retirement Health Benefits will be updated at a later date by a member of the Employee Benefits Center.

Slide 29: Special Retirement Incentive (SRI) – Healthcare Options

Rates for 2022

Slide 30: Cigna Health Plans

If you and your spouse/DP/Dependents are under the age of 65 and not Medicare eligible as of your retirement date, you and your dependent(s) will be placed in the Non-Represented active employee Cigna health plan until you (Retiree) turn 65 and are Medicare Eligible.

If you are under the age of 65, you have a choice to go into the Cigna Choice Plan without an HSA contribution by UMS or you can enroll into the Cigna Copay plan.

| Employee Share of Premium | Choice | Copay |

|---|---|---|

| Employee Only | $82.62 | $107.45 |

| Employee Plus One | $198.44 | $257.55 |

| Family | $256.35 | $332.60 |

Slide 31: Aetna Medicare Advantage Plan

Once the retiree turns age 65 and enrolls in Medicare parts A&B, you as the retiree have the choice to move to Aetna Medicare Advantage Plan which supplements Medicare part B or you can enroll into an individual plan within the AON/Alight Retiree Health Exchange with a HRA contribution of $2100.00 a year (prorated if less than a full calendar year).

The Aetna rates for 2022 per month are:

| Employee Share of Premium | Aetna |

|---|---|

| Retiree | $54.00 |

| Spouse/Domestic Partner | $136.00 |

| Retiree Plus One | $190.00 |

Slide 32: Cigna Non-Medicare

When a retiree turns age 65 and becomes Medicare eligible and your dependent(s) are under age 65, your dependent(s) have options:

- Your dependent(s) stay on the UMS Non-Represented Cigna plan but will be required to pay the Non-Medicare eligible premium rate for the Cigna Co-pay Plan or the Cigna Choice Plan.

- At the time you turn age 65 and become Medicare Eligible, your dependent(s) can decide to leave UMS Cigna health plan and find medical coverage outside UMS and then come back into UMS retiree health benefits when they turn age 65 (and become Medicare eligible). At that time, they can go into the Aetna or AON/Alight exchange alongside you.

For Example – 2 Person Non-Medicare Eligible Rates:

| Plan | Copay | Choice |

|---|---|---|

| Both Under Age 65 | $4,176.00 | $3,274.00 |

| Retiree Under Age 65, Spouse Over | $1,898.00 | $1,488.00 |

| Retiree Over Age 65, Spouse Under | $949.00 | $744.00 |

Slide 33: Healthcare Options – Continued

If at the time of retirement, the Retiree is under age 65 (not Medicare Eligible) but their Dependent (s) are over the age of 65 (and must be Medicare parts A&B enrolled as of the retirement effective date), the dependent can enroll into the Aetna group health plan and the retiree will be responsible for paying the active 2 person non-represented Cigna medical plan.

This rate will continue until the Retiree reaches age 65 (and enrolls in Medicare A&B) and then makes the decision to enroll into the Aetna group plan offering or the AON/Alight Retiree Health Exchange with an HRA contribution.

Slide 34: Questions?

If you have any questions, please do not hesitate to contact your campus Human Resources office.

Back to Special Retirement Incentive for AFUM and Non-Represented Faculty Page