Subject: Cost Sharing

Issue 6

Effective 12/26/2014

Posted 02/02/18

Purpose of Guidelines and Types of Cost Sharing

This document explains administrative requirements and financial procedures for maintaining compliance with government and other regulations regarding cost sharing of sponsored projects. Cost sharing occurs when a portion of project costs are not paid by the sponsor.

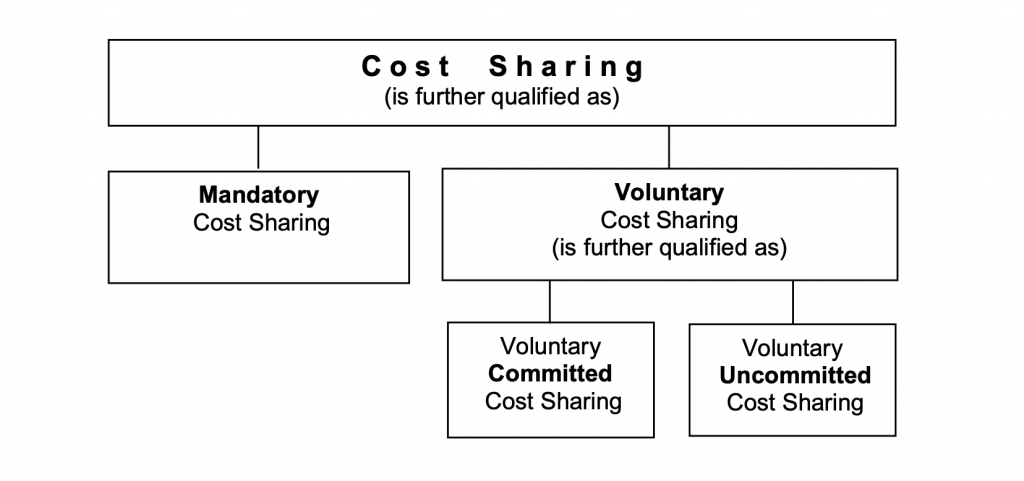

There are three types of cost sharing:

Mandatory Cost Sharing

This type of cost sharing occurs when a sponsor’s public announcement of a project requires cost sharing as a condition for proposal submission. It is an eligibility factor for applying for the grant. Mandatory cost sharing must be documented and is reportable to the sponsor. It is quantified in the proposal narrative, the proposal budget, or in award documents.

Voluntary Committed Cost Sharing

This type of cost sharing consists of costs specifically pledged on a voluntary basis and specifically included in the award budget. According to the OMB Uniform Guidance §200.306(a) “Under federal research proposals, voluntary committed cost sharing is not expected and cannot be used as a factor during the merit review of applications or proposals but may be considered if it is both in accordance with Federal awarding agency regulations and specified in the notice of funding opportunity.”

Once it becomes part of a signed agreement, however, the UMS is “committed” to providing the cost sharing, documenting it and reporting it subject to sponsor requirements. Voluntary committed cost sharing is quantified in the proposal narrative, the proposal budget, or in award documents.

Voluntary Uncommitted Cost Sharing

This type of costs sharing consists of costs incurred on a voluntary basis but not pledged in the proposal and not subsequently stated in award documents. It occurs, for example, when a PI contributes more time and effort than what was committed to the sponsored project in the agreement. It also includes cost overruns the UMS covers on a sponsor-funded project or on voluntary committed cost sharing. Voluntary Uncommitted Cost Sharing does not need to be tracked or reported unless it is related to non-salary cost overruns, in which case it must be identified and included in the modified total direct cost (MTDC) base.

Policy

It is the policy of the University of Maine System (UMS) that only mandatory cost sharing is offered to sponsors. This policy does not preclude exceptions that may be judged appropriate under certain circumstances to leverage a project. Mandatory cost sharing requirements are usually defined by law, statute, agency regulations, or written in the application or funding notice for a specific program. When there is mandatory cost sharing a copy of the request for proposal (RFP), regulations or guidelines must be submitted with the proposal. All voluntary committed cost sharing must be approved by the applicable UMS Dean, Department Chair, and in certain cases, Vice President of Research, and forwarded with the proposal to the applicable University Office of Sponsored Programs (OSP).

In cases where commitments of UMS resources are made on sponsored programs, the applicable University OSP and the committing schools or departments will ensure that the allocation of resources is consistent with UMS costing policies governing sponsored program expenditures and indirect cost calculations. In addition, cost-shared expenses (including cost shared F&A) will be verifiable from UMS records regardless of the reporting requirements of the sponsor.

Who is Responsible

Principal Investigators

Responsibility for following these guidelines lies primarily with Principal Investigators (PIs) or Project Directors, their Department Chairs or other direct supervisors, and unit-level fiscal personnel with the general guidance and oversight of the colleges, schools and divisions. Upon award, PIs are responsible for ensuring that cost-shared commitments are fulfilled and that cost-shared expenses are posted to the correct accounts in the UMS’ general ledger system.

Sponsored Programs Office

The applicable University OSP or other designated personnel are responsible for providing general guidance and technical assistance as well as reviewing proposal narratives for cost sharing commitments, for minimizing cost sharing commitments, and for verifying the approval as well as the appropriateness of the source accounts for the funding of the committed cost share. The University OSP is also responsible for managing the effort reporting process for committed cost sharing and for ensuring that unallowable costs, such as salaries over regulatory caps, are not counted towards cost sharing commitments.

University Services

The UMS University Services is responsible for providing guidance through administrative practice letters, business process documents, and coordinating compliance monitoring through periodic internal and external audits.

Responsibilities and Procedures

A. Basic Considerations

Expenses incurred to meet the UMS cost sharing commitments bring the same accounting, financial, legal, and regulatory burdens as sponsored funded costs. Cost shared expenses must be in compliance with the following:

- UMS expenditure policies

- Any additional terms specified by the sponsor

- Costing policies disclosed and approved by the federal government in the UMS’ Disclosure Statement (DS-2)

- U.S. Federal agency guidelines or non-federal program guidelines, as appropriate

In addition to the above requirements, OMB Uniform Guidance §200.306(b) requires that any shared costs or matching funds and all contributions, including cash and third party in-kind contributions are:

- Verifiable from UMS records;

- Not included as contributed cost sharing on any other federally funded projects or programs;

- Necessary and reasonable for the accomplishment of the project or program objectives;

- Allowable under (OMB) Uniform Guidance (2 CFR Part 200) Subpart E – Cost Principles;

- Not paid by the federal government under another federal award, except where the federal statute authorizing a program specifically provides that federal funds made available for such program can be applied to matching or cost sharing requirements of other federal programs;

- Provided for in the approved budget when required by the federal awarding agency; and

- In compliance with other provisions of OMB Uniform Guidance (2 CFR Part 200) as applicable.

B. Funding Sources for Cost Sharing

Funding of the UMS’ cost sharing commitments typically comes from the following sources:

1. UMS Cost Sharing

The UMS funds cost sharing expenses from its educational and general (E&G) budget or from qualified restricted monies such as gifts, endowment distributions, Maine Economic Improvement Fund monies, etc.

2. Sponsored Cost Sharing

The UMS funds cost sharing commitments using existing (usually nonfederal) sponsored grants and contracts. These types of commitments must be tracked manually. Note that expenditures on a federal sponsored project may not be used to meet the cost sharing requirements on other federally funded projects unless specifically authorized by the federal agency.

3. In-kind Cost Sharing

Third party non-cash contributions of time, talent, or resources from the UMS or donated by third parties for which the UMS is responsible. Third party in-kind contributions may be in the form of real property, equipment, supplies and other expendable property, or goods and services directly benefiting and specifically designated for the project or program.

C. Types of Expenditures that Can Be Cost Shared

Cost sharing commitments can be met using direct (effort, equipment, and other direct expenses) or indirect (facilities and administrative (F&A)) costs that are allowable, allocable, reasonable, and consistently accounted for by the UMS.

1. Direct Costs

a. Faculty Effort or Research Staff Salary

PIs can commit to expend faculty or research staff effort on a sponsored project. Such a commitment of effort binds the UMS to contribute research staff or faculty time to the project and to record salary expenditures, including fringe benefits, in a manner that makes the expenditure verifiable from UMS records. Like all committed effort, cost-shared faculty and research staff effort must be accordingly reported on the time and effort reports.

b. Equipment

Equipment purchased with UMS resources cannot ordinarily be offered as cost sharing, since the depreciation of UMS owned equipment is included in the F&A cost rates and the equipment was not purchased for use on the project. Rather than committing the use of UMS owned equipment as cost sharing, proposals should characterize the equipment as “available for the performance of the sponsored agreement at no direct cost to the project.” If, however, the purchase of equipment is necessary for the project or the sponsor mandates the purchase of equipment, then the acquisition cost of the specific equipment may be offered as cost sharing. In such cases, the purchase and acquisition must occur during the period of performance of the project, and the procedures must be in place to ensure that the depreciation on such equipment is not included in the F&A cost rate calculation.

c. Other direct costs

Most other costs that could be charged (allowable, allocable, reasonable, and consistently treated) to a sponsored project can be cost-shared. The following are examples of other direct costs that may be cost-shared:

-

- Travel expenses

- Laboratory expenses

- Equipment items that do not meet the capitalization threshold (currently $5,000)

2. Indirect Costs (F&A Costs)

F&A costs may be offered in a proposal to meet cost sharing requirements imposed by a sponsor. There are two ways to cost share F&A costs on sponsored projects:

a. Unrecovered F&A on sponsored expenditures

The amount of F&A not collected from the sponsor that could have been allocated to the direct costs paid by the sponsor of an award. Unrecovered F&A typically results from awards made by sponsors that do not pay the full negotiated F&A rate. For federal sponsors, OMB Uniform Guidance §200.306(c) states that “Unrecovered indirect costs, including indirect costs on cost sharing or matching may be included as part of cost sharing or matching only with the prior approval of the Federal awarding agency.”

Agreements with the Federal Government – Generally, the UMS expects to recover the full amount of F&A costs consistent with its negotiated rates and allowable under the specific guidelines of the grant/contact program. In some cases an agency may either cap the recovery rate (for example, some U.S. Department of Education programs only allow for an 8% recovery), or require cost sharing which may be met with a waiver of direct and/or F&A costs. It is only when these restrictions are noted in the sponsor guidelines that a waiver is assumed. Further authorizations will be required unless a sponsor provides notice in writing that the funding program has an F&A reimbursement cap that is lower than the UMS federally negotiated rate.

Agreements with the State of Maine – All proposals submitted to any State of Maine agency or department for work to be carried out under either a State/University Cooperative Agreement or an Agreement to Purchase Services will carry an F&A rate of no less than one-half of the UMS federally negotiated rate for the specific type of project being proposed. This reduction in rate applies only to agreements for which the State makes the funding decision and has control of the funds (i.e., State tax revenues or Federal block grants to the State).

Agreements with Foundations and Other Entities – Generally, the UMS expects to recover the full amount of F&A costs consistent with UMS federally negotiated rates and allowable under the specific guidelines of the grant/contract program.

For any project jointly proposed to a third-party funder, the F&A policy of that party applies. For example, projects jointly submitted to the federal government whose guidelines allow for full recovery of F&A should be submitted as such.

b. F&A on cost shared direct costs

The amount of F&A, calculated at the full negotiated F&A rate, allocated to direct costs cost shared by the UMS.

D. Proposing Cost Sharing

When cost sharing is mandatory or voluntary committed, the department responsible for the project must include it in the proposed budget. In both cases, the source of cost sharing funds must be identified in the proposal. UMS and third party in-kind commitments must be described in detail, have an established value, and be included in the proposal.

As described above, cost sharing may consist of direct costs and/or unrecovered indirect (F&A) costs.

Funds designated for proposed cost sharing must be designated for the proposed project only. They cannot be included in a proposal if they have already been earmarked for a different project in another proposal or have been expended in another period.

As previously noted in this APL, sponsor funds, including federal and federal pass-through funds, may not be used for cost sharing unless specifically authorized by the sponsor of those funds.

Before proposing in-kind voluntary committed cost sharing, a department should be aware of and be prepared to meet documentation and reporting requirements outlined below. In-kind mandatory and in-kind voluntary committed cost sharing included in a proposal may, but do not always, appear in the written award document.

E. Establishing the Value of In-Kind Contributions

Values of in-kind contributions from the UMS or a third party must be established in accordance with OMB Uniform Guidance Subpart E – Cost Principles §200.434- Contributions and donations:

- Depreciable Personal Property: The assessed value of donated personal property, e.g., equipment, must not exceed the fair market value of personal property of the same age and condition at the time of donation. The assessed value for loaned equipment must not exceed its fair rental value.

- Supplies/Materials: The assessed value must be reasonable and must not exceed the fair market value at the time of the donation.

- Buildings or land contributed by the UMS: The assessed value must be the lesser of the:

- book value as shown in the UMS accounting records at the time of donation, or current fair market value.

- Buildings or land contributed by a third party: The assessed value shall not exceed fair market value at the time of donation as established by an independent appraiser and certified by a responsible official of the University.

- Space contributed by a third party: The assessed value for donated space must not exceed the fair rental value of comparable space as established by an independent appraiser.

- Personal services: When the contribution is in the form of effort, it is valued at the regular rate of compensation. The “regular” rate of compensation is the rate an individual earns when performing comparable work. Fringe benefits that are reasonable, allowable and allocable may be included in the valuation.

When an employer other than the UMS furnishes the services of an employee, the services shall be valued at the employee’s regular rate of pay (plus an amount of fringe benefits that are reasonable, allowable, and allocable).

F. Documenting Cost Sharing

The UMS must maintain sufficient supporting documentation to substantiate the mandatory and voluntary committed cost sharing contributions to a project. The documentation is to be retained for the period required by the sponsor, or the retention policy of the UMS, whichever is longer.

1. Costs Paid by the UMS

Cost shared expenses paid by the UMS are documented by recording them in the UMS’ general ledger system. Costs paid from unrestricted sources are segregated from those paid from restricted sources. The applicable University OSP is responsible for recording each cost sharing budget.

2. Documenting In-Kind Contributions

The department responsible for the sponsored project is responsible for keeping detailed, auditable records of in-kind cost sharing and for submitting copies of those records to its University OSP, or other responsible department, on an ongoing basis throughout the life of the project. The department is also responsible for documenting the basis used to determine the valuation for personal services, materials, depreciable personal property, buildings and land.

G. Reporting Cost Sharing

If required by the sponsor, the University OSP reports mandatory cost sharing and voluntary committed cost sharing. The terms and conditions of the award or the sponsor’s policies will indicate whether the cost sharing is reportable. If the sponsor is silent, the University OSP is not required to report cost sharing; however a record of the cost sharing will still be maintained in the UMS’ general ledger system and departments must still maintain supporting documentation.

Reporting of voluntary uncommitted cost sharing is not required.

Definitions and Terms

Committed Effort:

Percentage of a researcher’s time that has been pledged to a project, regardless of whether the effort is funded by the sponsor or through cost sharing.

Cost Sharing (or Matching):

“Cost sharing or matching means the portion of project costs not paid by federal funds (unless otherwise authorized by federal statute).” [2 CFR § 200.29]

Care should be taken when using these terms because sponsor definitions can vary. The UMS uses “cost sharing” and “matching” synonymously, with “cost sharing” as the preferred term. The umbrella term “cost sharing” describes that portion of total project or program costs not borne by a sponsor.

F&A Cost Sharing:

In some cases, F&A not collected by the UMS when a sponsor does not pay the full negotiated F&A rate may be used to fulfill a sponsor’s cost sharing requirement.

In-Kind Cost Sharing:

In-kind contributions are non-cash contributions provided by the UMS and/or third parties. They are in the form of goods, commodities or services and can include real property, non-expendable personal property, and depreciation expense on previously purchased equipment. They can include volunteer services provided by professional and technical personnel, consultants and other skilled and unskilled labor. In all cases, in-kind contributions must directly benefit and be specifically identifiable to the project or program.

Over-the-cap-Cost Sharing:

Includes the portion of a faculty or staff member’s salary that exceeds a regulatory maximum imposed by the sponsor. Over-the-cap cost sharing must be included in the direct cost base for indirect cost calculations and it cannot be used to meet cost sharing commitments on sponsored programs.

Overrun Cost Sharing:

Cost incurred to complete a sponsored project that exceed the amount awarded by the sponsor. These costs must be included in the direct cost base for indirect cost calculations.

Restricted Cost Sharing:

Cost expended in support of a sponsored project and funded with restricted UMS funds including gift, endowment, MEIF, or other restricted sources.

Third Party:

A “third party” is an entity other than the principals—an entity other than the University and other than the sponsor. Contributions from a third-party are generally “in-kind”, but they may also be cash. When a third party makes a cash contribution, the UMS places it into a restricted, expendable fund. The UMS can use these funds for cost sharing provided doing so is not contrary to the third party’s restrictions. The UMS documents the third party’s cash cost sharing by transferring the funds to a project’s Restricted Cost Sharing Fund Code 24.

Unrecovered Overhead:

See F&A Cost Sharing

Unrestricted Cost Sharing:

Costs expended in support of a sponsored project and funded with unrestricted UMS funds.

Related Documents

Accounting for Grants and Contracts – business process document

APL III-A Institutionally Designated Account Guidelines

APL VIII-B Restricted Expendable Funds Guidelines

History of Administrate Practice Letter

Issue 2: Effective 1/13/1986

Issue 3: Effective 6/15/2006 (defines current cost sharing terminology as described in A-110, replaces FAST terms with PeopleSoft terms, removes policy on percentage distribution of F&A cost recovery)

Issue 4: Effective 04/02/2007 (adds information on in-kind contributions and valuation; adds “Policy” and “History of Policy” sections)

Issue 5: Effective 05/28/2009 (further defines UMS Policy section, clarifying expectations regarding F&A cost recovery)

Issue 6: Effective 12/26/2014 (updates the regulatory requirements and references to reflect the adoption of Uniform Guidance)

Approved Vice Chancellor for Finance and Administration

Signature on file in the Office of Finance and Administration